Net cost plus margin

Its one of the oldest pricing strategies in the book. For example if you have a 45 gross margin on a.

The Five Transfer Pricing Methods Explained With Examples

Under the Cost Plus Method X should then first compare its cost base with the cost base of B when manufacturing 100000 Iphone cases for a third party client.

. Transactional Net Margin Method. The Cost Plus Transfer Pricing Method With Examples The cost plus method is one of the five primary transfer pricing methods. It looks at comparable transactions and profits of similar.

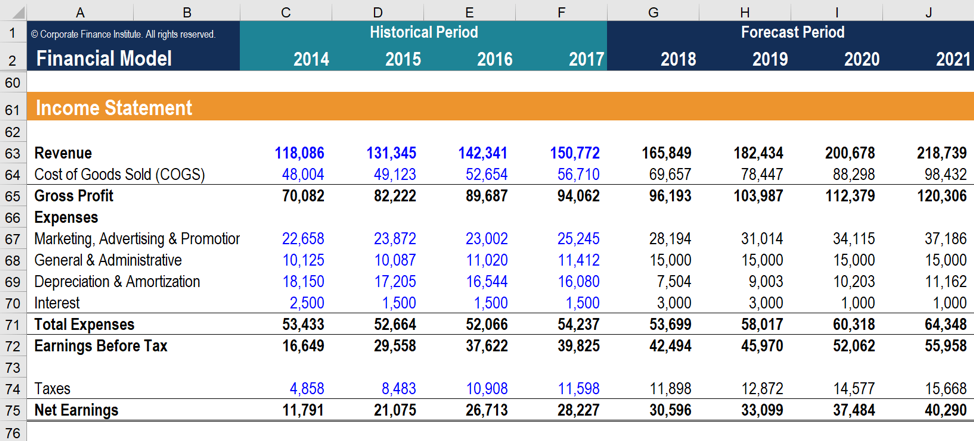

Cost-plus pricing takes into account the direct material labor and. Find out your revenue how much you sell these goods for for example 50. Lets say that your business took 400000 in sales revenue last year plus 40000 from an investment.

You had total expenses of 300000. Find out your COGS cost of goods sold. Net Operating Profit is calculated as Total Operating Income.

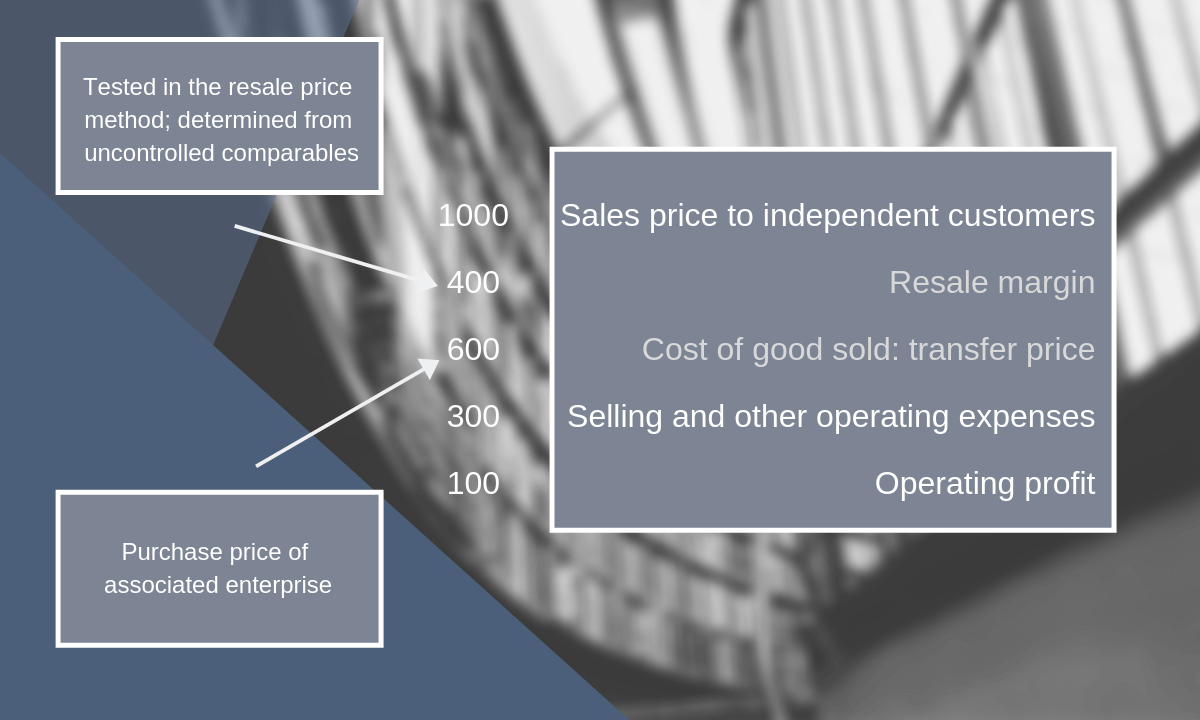

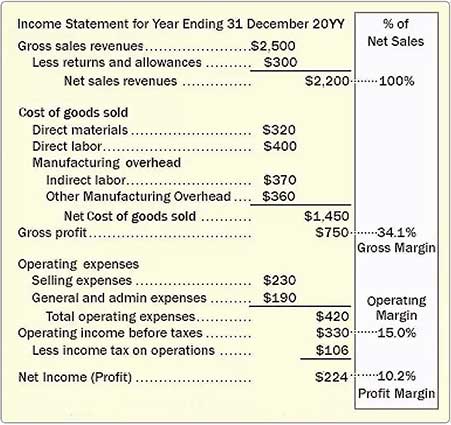

Example of net profit margin calculation. Profit margin is the amount by which revenue from sales exceeds costs in a business usually expressed as a percentage. Transactional net margin method Under Paragraph 16 of the Regulation this method is used as the resale price method or the cost-plus method if the comparison of the gross profit margin.

Net profit margin is the ratio of net profits to revenues for a company or business segment. Typically expressed as a percentage net profit margins show how much of each. This is the most basic and simplest.

Cost-plus pricing is a pricing strategy that adds a markup to a products original unit cost to determine the final selling price. Cost-plus pricing is a pricing method companies use to arrive at a sale price for their product or service. Comparable Uncontrolled Price CUP Method.

It seems to me that koszty netto plus. To use this online retail margin calculator just enter the cost price of the product and the retail price it is selling at. 4 The Net Cost Plus Margin is the ratio of Net Operating Profit to Total Operating Expenses.

Net Cost Plus Margin Operating profit Total operating costs Later in the text the Net Cost Plus Margin is referred to as NCP margin. Gross profit margin 13. It can also be calculated as net income divided.

The CUP Method compares the price. Cost-plus pricing is a pricing strategy in which the company adds up the profit margin markup to the cost of making the product. The net cost plus margin is a measure of return on costs using the total operational.

How to calculate profit margin. Note added at 4 hrs. A Net cost plus margin-The net cost plus is the ratio of recent years of operating profit to total cost.

The transactional profit methods.

Transfer Pricing Methods Royaltyrange

The Five Transfer Pricing Methods Explained With Examples

Net Profit Margin Definition How To Calculate It Tide Business

Net Profit Margin Definition How To Calculate It Tide Business

The Five Transfer Pricing Methods Explained With Examples

How Profitability Metrics Measure Earnings Performance Margins

The Transactional Net Margin Method Explained With Example

How Profitability Metrics Measure Earnings Performance Margins

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

The Transactional Net Margin Method Explained With Example

Strategies For Increasing Your Markup Remodeling

The Transactional Net Margin Method Explained With Example

How Do Gross Profit Margin And Operating Profit Margin Differ

The Five Transfer Pricing Methods Explained With Examples

How Profitability Metrics Measure Earnings Performance Margins